Stokastik osilatör, ko'pincha Stochastics yoki shunchaki STOCH deb ataladi, moliya bozorlarida aktiv narxlarining haddan tashqari sotib olingan yoki haddan tashqari sotilgan holatlarini baholash uchun keng qo'llaniladigan boshqa mashhur moment osilatöridir. Stokastik osilatör 1950-yillarning oxirida George Lane tomonidan ishlab chiqilgan.

STOCH indikatorida aktivning yopilish narxi ma'lum bir davrdagi narx diapazoniga solishtiriladi, odatda 14 davr. U ikki chiziqdan iborat: %K chizig'i va %D chizig'i. %K chizig'i joriy yopilish narxining narx diapazoniga nisbatan holatini bildiradi, %D chizig'i esa %K chizig'ining silliqlashtirilgan harakatlanuvchi o'rtacha qiymatidir.

Stokastik osilatörni hisoblash formulasi quyidagi bosqichlarni o'z ichiga oladi:

Tanlangan davrdagi aktiv yopilish narxi va narx diapazonidagi eng past qiymat farqini hisoblang.

Xuddi shu narx diapazonidagi eng yuqori va eng past qiymatlar farqini hisoblang.

Birinchi farqni ikkinchi farqqa bo'ling va natijani 100 ga ko'paytiring, %K chizig'ini olish uchun.

%D chizig'ini olish uchun %K chizig'ining silliqlashtirilgan harakatlanuvchi o'rtacha qiymatini (odatiy 3 davr SMA) hisoblang.

Stokastik osilatör 0 dan 100 gacha bo'lib, odatda grafikda ikki chiziq sifatida ko'rsatiladi. %K chizig'i yanada o'zgaruvchan, %D chizig'i esa silliq va %K chizig'i bilan kesishmalar asosida signal beradi.

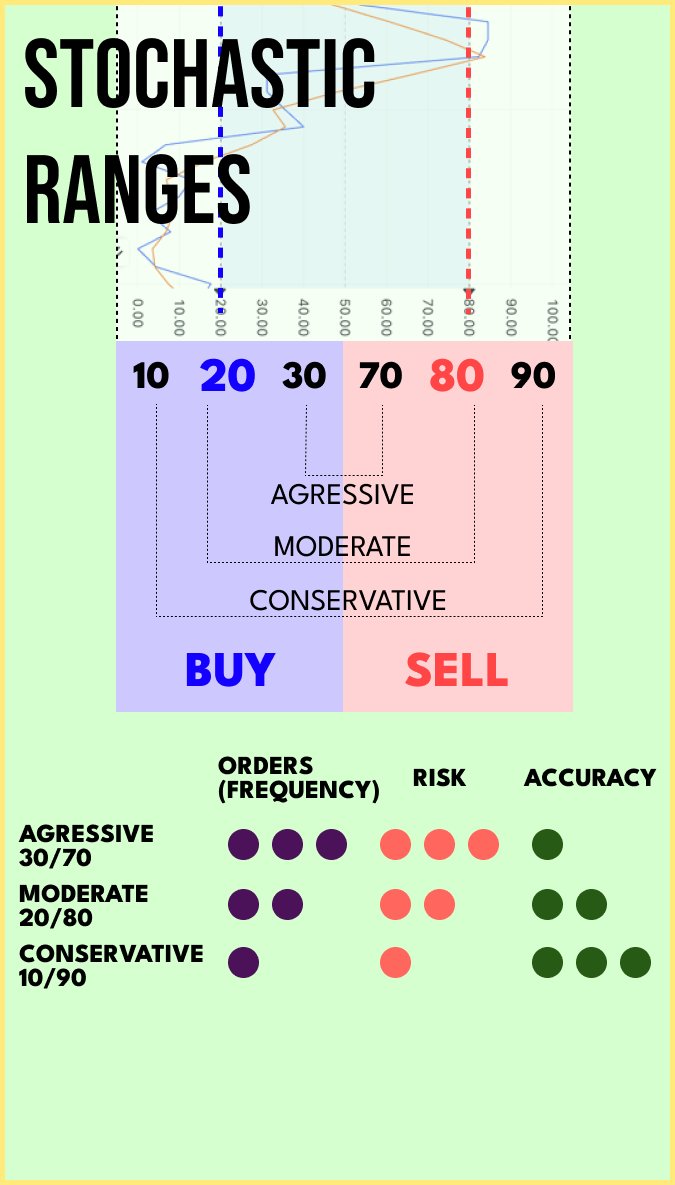

Treyderlar Stokastik osilatörni potentsial trend o'zgarishlarini va narx farqlarini aniqlash uchun ishlatadilar. %K chizig'i sotilgan daraja ostidan (%20 dan past) %D chizig'ini kesib o'tganda, potentsial xarid imkoniyatini ko'rsatadigan bullish signal hosil bo'ladi. Aksincha, %K chizig'i sotib olingan daraja ustidan (%80 dan yuqori) %D chizig'ini kesib o'tganda, potentsial sotish imkoniyatini ko'rsatadigan bearish signal hosil bo'ladi.

Stokastik osilatör, har qanday indikator kabi, cheklovlarga ega va xato signallar berishi mumkin, ayniqsa trend bozorlarida. Shu sababli, treyderlar STOCH ni boshqa indikatorlar va vositalar bilan birgalikda ishlatib, samaradorlik va aniqlikni oshiradilar.

Har qanday texnik tahlil vositasi singari, to'g'ri xavf boshqaruvini amalga oshirish va faqat Stokastik osilatörga tayanmaslik muhimdir. Bir nechta indikatorlarni birlashtirish va puxta tahlil qilish treyderlarga moliya bozorlarida ongliroq qarorlar qabul qilishga yordam beradi.