EURUSD Commodity Channel Index (CCI)

ILOVANI YUKLAB OLISH

EURUSD CCI Today Technical Analysis

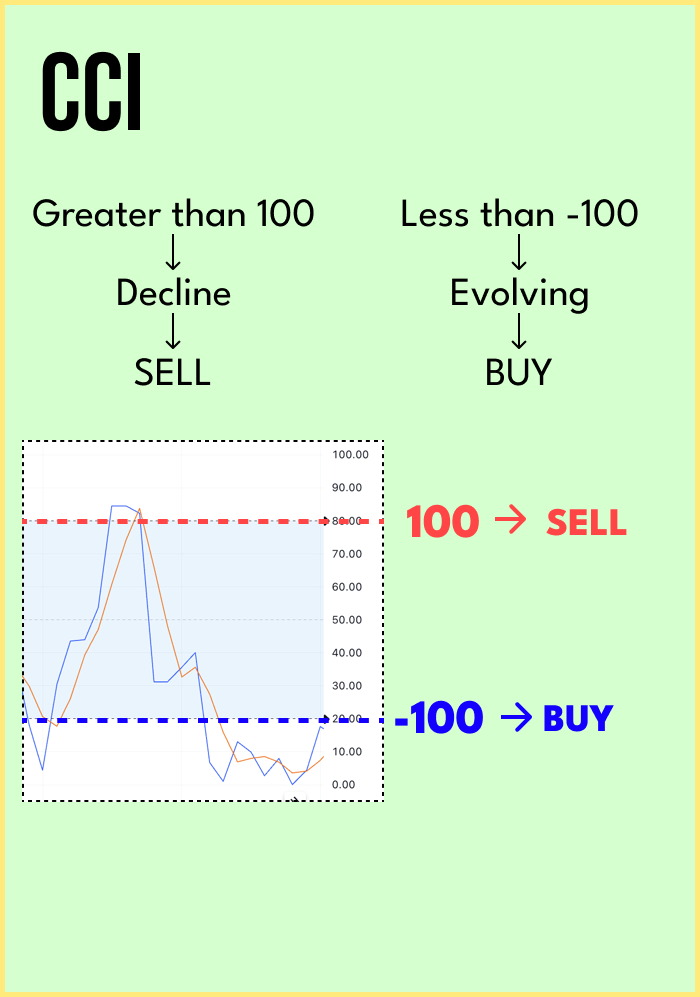

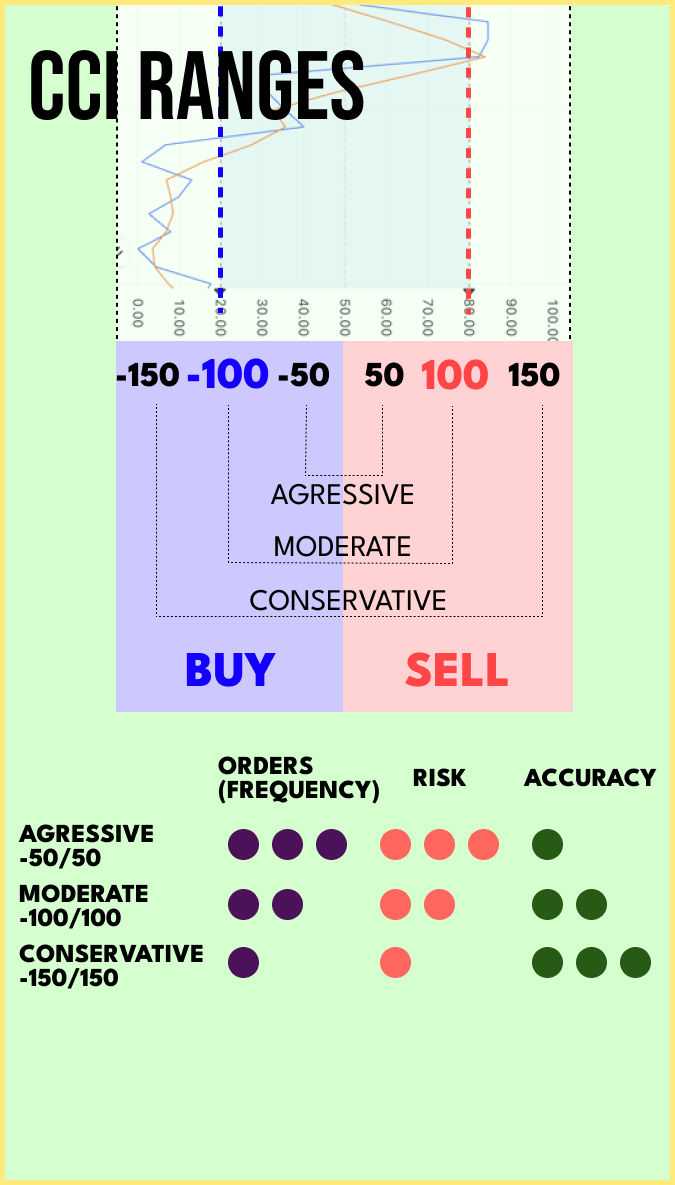

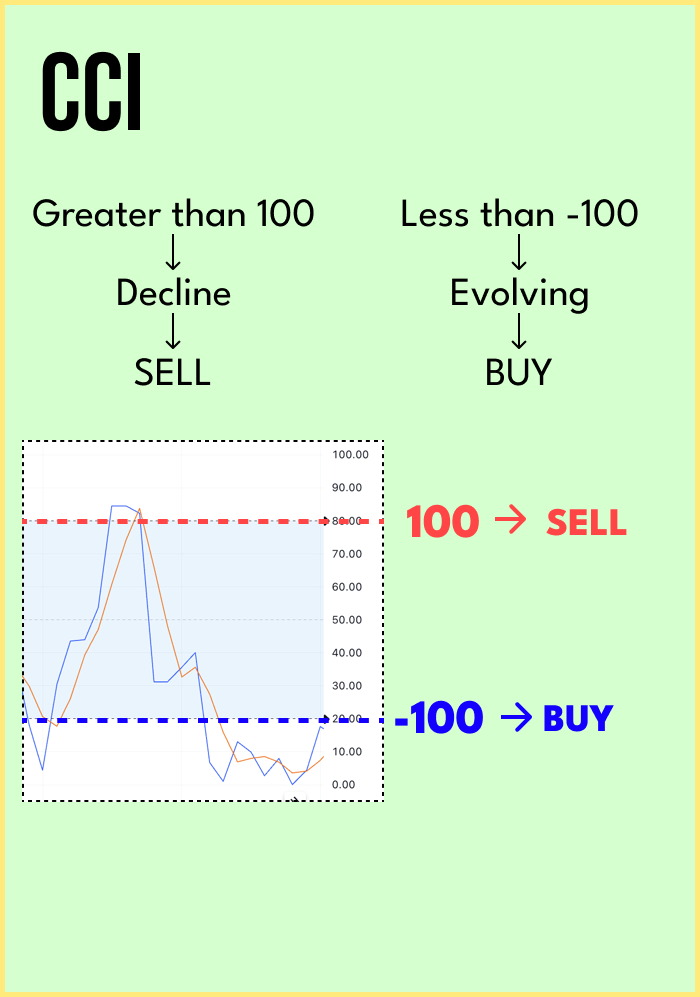

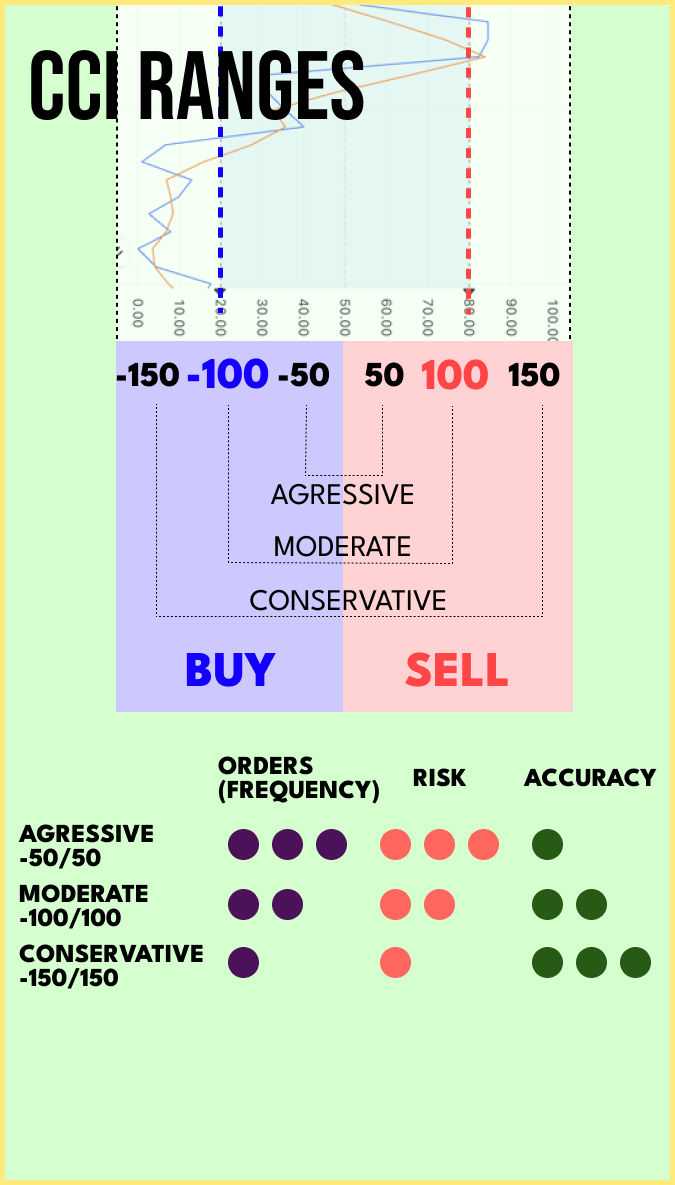

EURUSD joriy bozor tahlili CCI (Tovar Kanal Indikatori) ko'rsatkichiga asoslanadi. Hozirgi kunda valyuta juftligi nisbatan barqaror holatda, lekin o'zgaruvchan tendentsiyalarni ko'rsatmoqda. CCI indikatori -100 dan +100 oralig'ida siljimasdan turgan bo'lib, bu valyuta kursi hozircha aniq yo'nalishga ega emasligini bildiradi.

Yaqin kelajakda EURUSD kursiga ta'sir etuvchi asosiy omillar Federal Zaxira tizimi va Yevropа Markaziy Bankining pul-kredit siyosatlari bo'ladi. Iqtisodiy ko'rsatkichlar, siyosiy barqarorlik va geosiyosiy holatlar valyuta kursi dinamikasiga sezilarli ta'sir ko'rsatishi mumkin.

Investorlar va treyderlar CCI indikatorining 100 va -100 chegaralaridan o'tish ehtimolini diqqat bilan kuzatib borishlari kerak, chunki bu muhim signallar berishi mumkin.

Joriy signallar

| Indikator |

Ticker |

Vaqt oraligi |

Oraliq |

Signal |

| CCI |

EURUSD |

1 min |

-100 / 100 |

BUY |

| CCI |

EURUSD |

5 min |

-100 / 100 |

BUY |

| CCI |

EURUSD |

1 min |

-150 / 150 |

BUY |

| CCI |

EURUSD |

1 min |

-200 / 200 |

BUY |

| CCI |

EURUSD |

1 min |

-50 / 50 |

BUY |

Reyting

So‘nggi 7 kunning eng yaxshi ijrochilari, siz kuzatayotgan EURUSD-CCI

So‘nggi yopilgan signallar

| Ochilish vaqti |

Yopilish vaqti |

Indikator |

Signal |

Ochiq -> Yopiq : PL |

| 02/19/2026, 03:41:00 |

02/19/2026, 03:42:00 |

CCI

1 min

-50 / 50

EURUSD

|

SELL |

1.179000 ->

1.178880 :

12.00

|

| 02/19/2026, 03:22:00 |

02/19/2026, 03:41:00 |

CCI

1 min

-50 / 50

EURUSD

|

BUY |

1.179160 ->

1.179000 :

-16.00

|

| 02/19/2026, 03:19:00 |

02/19/2026, 03:22:00 |

CCI

1 min

-50 / 50

EURUSD

|

SELL |

1.179280 ->

1.179160 :

12.00

|

| 02/19/2026, 03:12:00 |

02/19/2026, 03:19:00 |

CCI

1 min

-50 / 50

EURUSD

|

BUY |

1.179100 ->

1.179280 :

18.00

|

| 02/19/2026, 03:10:00 |

02/19/2026, 03:13:00 |

CCI

1 min

-100 / 100

EURUSD

|

SELL |

1.179260 ->

1.179100 :

16.00

|

| 02/19/2026, 03:06:00 |

02/19/2026, 03:12:00 |

CCI

1 min

-50 / 50

EURUSD

|

SELL |

1.179290 ->

1.179100 :

19.00

|

| 02/19/2026, 02:50:00 |

02/19/2026, 03:10:00 |

CCI

1 min

-100 / 100

EURUSD

|

BUY |

1.179400 ->

1.179260 :

-14.00

|

| 02/19/2026, 02:49:00 |

02/19/2026, 03:06:00 |

CCI

1 min

-50 / 50

EURUSD

|

BUY |

1.179420 ->

1.179290 :

-13.00

|

| 02/19/2026, 24:50:00 |

02/19/2026, 02:50:00 |

CCI

5 min

-100 / 100

EURUSD

|

SELL |

1.179010 ->

1.179060 :

-5.00

|

| 02/19/2026, 02:32:00 |

02/19/2026, 02:50:00 |

CCI

1 min

-200 / 200

EURUSD

|

SELL |

1.179530 ->

1.179300 :

23.00

|

Commodity Channel Index (CCI) — moliya bozorlarida treyderlar va tahlilchilar tomonidan aktiv narxining momentumini va potentsial ortiqcha sotib olingan yoki ortiqcha sotilgan holatlarini baholash uchun ishlatiladigan mashhur texnik indikator. 1970-yillarning oxirida Donald Lambert tomonidan ishlab chiqilgan CCI aksiyalar, tovarlar va valyutalar kabi turli moliyaviy vositalarda keng qo'llaniladi.

CCI narxlar vaqt o'tishi bilan ma'lum bir diapazonda harakat qilishga moyil degan tushunchaga asoslanadi. U aktivning joriy narxi bilan uning tarixiy o'rtacha qiymati orasidagi farqni standart og'ish faktori bilan moslashtirib o'lchaydi. Indikator odatda nolga o'rnatilgan markaziy chiziq atrofida tebranadi va aktiv narxi tarixiy o'rtacha qiymatidan yuqorimi yoki pastligini ko'rsatadi.

Treyderlar Commodity Channel Index-dan potentsial sotib olish yoki sotish imkoniyatlarini aniqlash uchun keng qo'llaydilar. CCI ma'lum bir chegaradan oshsa, bu aktiv ortiqcha sotib olinganligini va potentsial narx o'zgarishi yoki tuzatish sodir bo'lishi mumkinligini bildiradi. Aksincha, CCI ma'lum bir chegaradan pastga tushsa, bu aktiv ortiqcha sotilganligini va potentsial narx ko'tarilishi kutish mumkinligini bildiradi.

Har qanday texnik indikator kabi, CCI boshqa tahliliy vositalar va indikatorlar bilan birgalikda ishlatilganda samaraliroqdir. Uning talqinlari va signal ishlab chiqarishi vaqt oralig'i va bozor sharoitiga qarab o'zgarishi mumkin. Treyderlar va investorlar CCI-ni trendni kuzatuvchi indikatorlar va boshqa momentum osilatörlari bilan birgalikda ishlatib, yanada ongli qarorlar qabul qilish va noto'g'ri signallarning ta'sirini kamaytirishga harakat qiladilar.

Umuman olganda, CCI aktiv narxining harakatlari haqida qimmatli tushunchalarni beradi, treyderlarga potentsial bozor tendentsiyalarini baholash, kirish va chiqish nuqtalarini aniqlash va xavfni samaraliroq boshqarishda yordam beradi. Biroq, hech bir indikator o'zi bilan foydali savdo natijalarini kafolatlamasligini va muvaffaqiyatli savdo strategiyalari uchun to'g'ri xavf boshqaruvi va puxta tahlil zarurligini yodda tutish muhimdir.

,