EURUSD Commodity Channel Index (CCI)

DOWNLOAD APP

EURUSD CCI Today Technical Analysis

The EURUSD currency pair is currently experiencing moderate volatility, with the Commodity Channel Index (CCI) providing insights into potential market movements. Recent CCI readings indicate a transition from overbought to neutral territory, suggesting a potential consolidation phase. The indicator's oscillation around the zero line signals uncertain market sentiment and reduced directional momentum.

Technical analysis reveals key support levels around 1.0700, with resistance forming near 1.0850. The CCI's recent behavior suggests traders should monitor short-term trend reversals and potential breakout opportunities. Macroeconomic factors, including divergent monetary policies between the European Central Bank and Federal Reserve, continue to influence exchange rate dynamics.

Investors should pay close attention to upcoming economic data releases, particularly inflation reports and central bank statements, which could trigger significant price movements. The current market environment demands a cautious approach with carefully managed risk strategies.

Current signals

| Indicator |

Ticker |

Timeframe |

Range |

Signal |

| CCI |

EURUSD |

1 min |

-100 / 100 |

SELL |

| CCI |

EURUSD |

5 min |

-100 / 100 |

SELL |

| CCI |

EURUSD |

1 min |

-150 / 150 |

SELL |

| CCI |

EURUSD |

1 min |

-200 / 200 |

BUY |

| CCI |

EURUSD |

1 min |

-50 / 50 |

SELL |

Leaderboard

7 days top performers who follow EURUSD-CCI

Last closed signals

| Time open |

Time close |

Indicator |

Signal |

Open -> Close : PL |

| 02/16/2026, 08:25:00 |

02/16/2026, 09:00:00 |

CCI

5 min

-100 / 100

EURUSD

|

BUY |

1.186160 ->

1.186700 :

54.00

|

| 02/16/2026, 08:23:00 |

02/16/2026, 08:45:00 |

CCI

1 min

-150 / 150

EURUSD

|

BUY |

1.186160 ->

1.186500 :

34.00

|

| 02/16/2026, 08:23:00 |

02/16/2026, 08:45:00 |

CCI

1 min

-100 / 100

EURUSD

|

BUY |

1.186350 ->

1.186350 :

0.00

|

| 02/16/2026, 08:23:00 |

02/16/2026, 08:44:00 |

CCI

1 min

-50 / 50

EURUSD

|

BUY |

1.186520 ->

1.186270 :

-25.00

|

| 02/16/2026, 08:05:00 |

02/16/2026, 08:25:00 |

CCI

5 min

-100 / 100

EURUSD

|

SELL |

1.186900 ->

1.186160 :

74.00

|

| 02/16/2026, 08:04:00 |

02/16/2026, 08:24:00 |

CCI

1 min

-200 / 200

EURUSD

|

SELL |

1.186700 ->

1.186080 :

62.00

|

| 02/16/2026, 08:03:00 |

02/16/2026, 08:23:00 |

CCI

1 min

-150 / 150

EURUSD

|

SELL |

1.186670 ->

1.186160 :

51.00

|

| 02/16/2026, 08:03:00 |

02/16/2026, 08:23:00 |

CCI

1 min

-100 / 100

EURUSD

|

SELL |

1.186560 ->

1.186350 :

21.00

|

| 02/16/2026, 08:03:00 |

02/16/2026, 08:23:00 |

CCI

1 min

-50 / 50

EURUSD

|

SELL |

1.186460 ->

1.186520 :

-6.00

|

| 02/16/2026, 07:20:00 |

02/16/2026, 08:05:00 |

CCI

5 min

-100 / 100

EURUSD

|

BUY |

1.186300 ->

1.186900 :

60.00

|

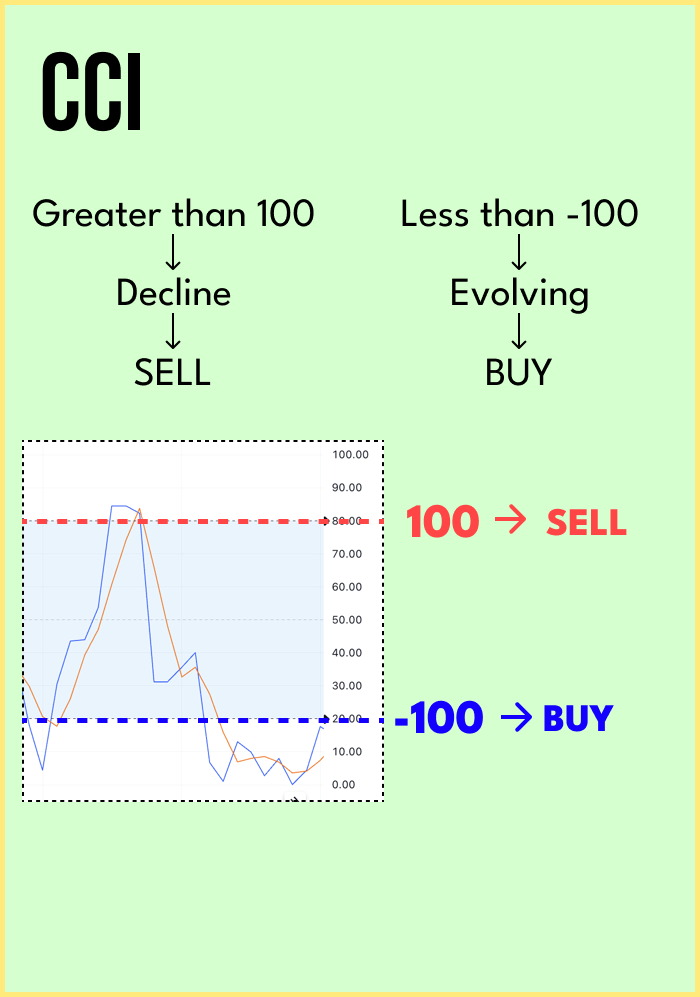

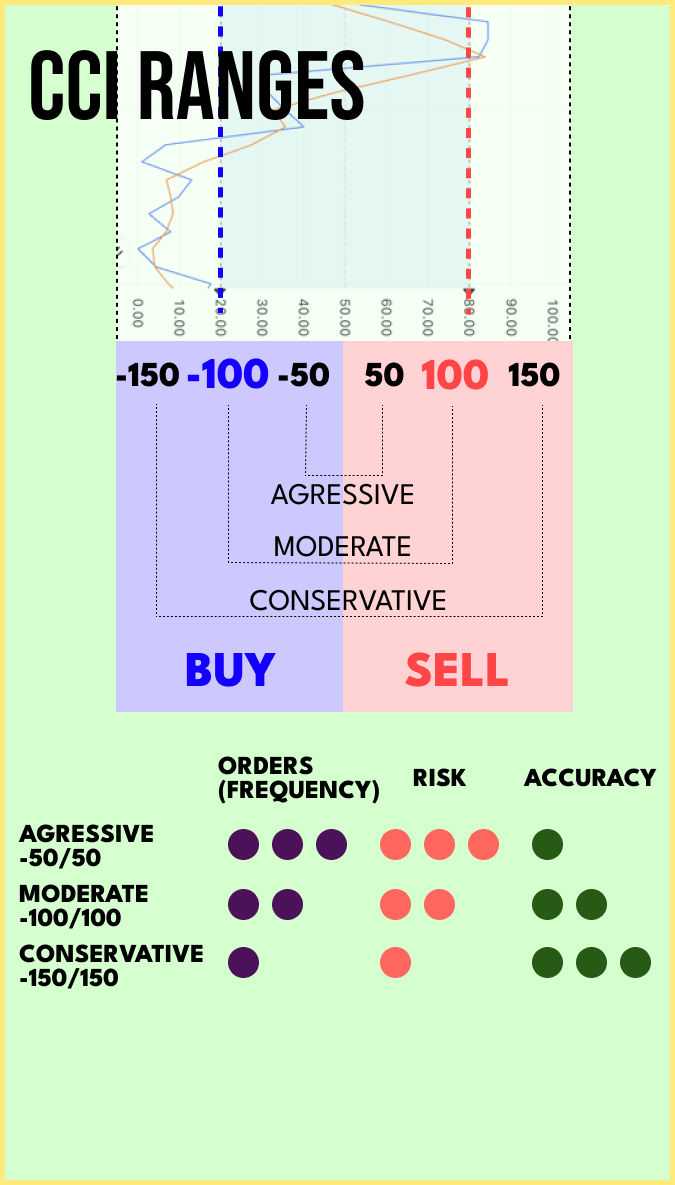

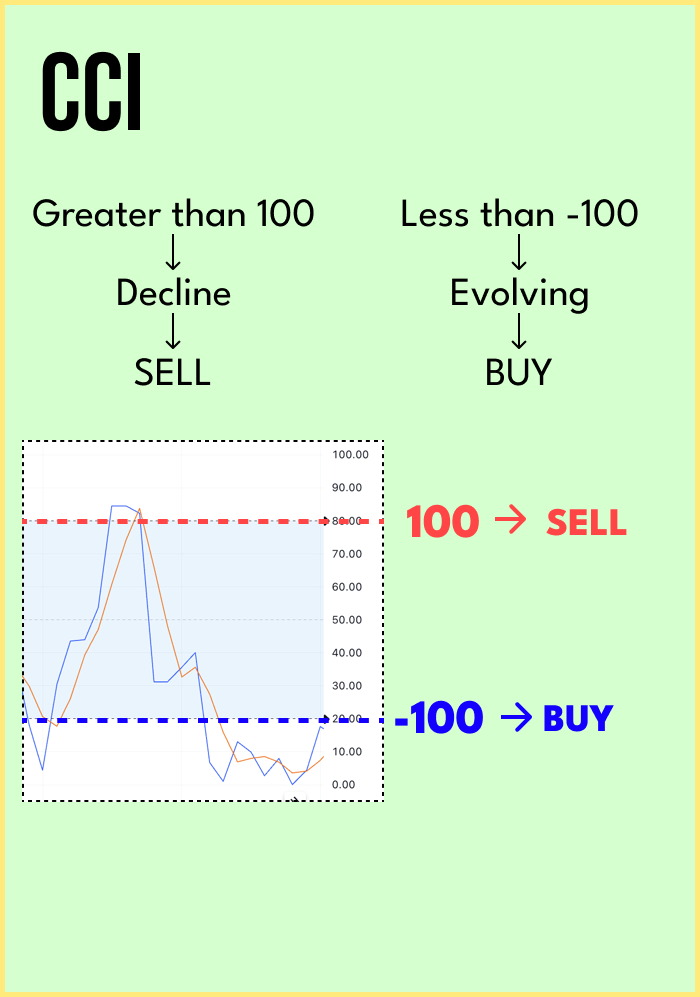

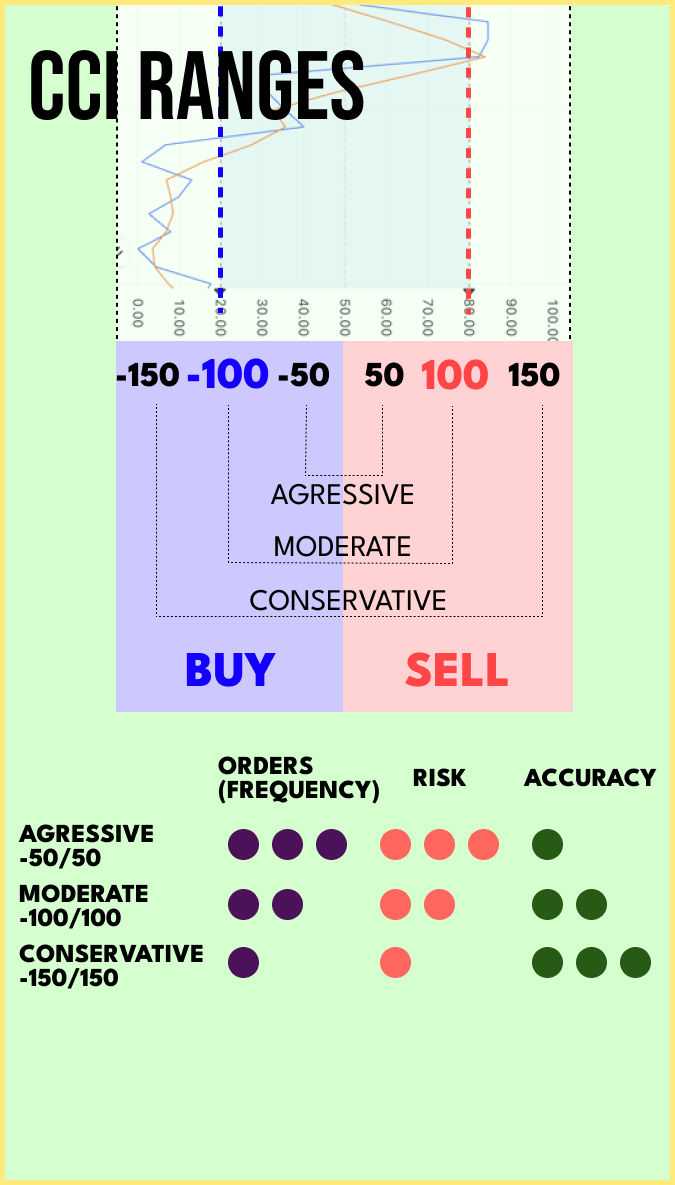

The Commodity Channel Index (CCI) is a popular technical indicator used by traders and analysts in financial markets to assess the momentum and potential overbought or oversold conditions of an asset's price. Developed by Donald Lambert in the late 1970s, the CCI is widely applied in various financial instruments, including stocks, commodities, and currencies.

The CCI is based on the concept that prices tend to move within a specific range over time. It measures the difference between an asset's current price and its historical average, adjusted by a factor of its standard deviation. The indicator oscillates around a center line, typically set at zero, indicating whether the asset's price is above or below its historical average.

Traders commonly use the Commodity Channel Index to identify potential buying or selling opportunities. When the CCI rises above a certain threshold, it suggests that the asset is in an overbought condition, and a potential price reversal or correction may be on the horizon. Conversely, when the CCI falls below a specific threshold, it indicates that the asset is oversold, and a potential upward price correction might be expected.

As with any technical indicator, the Commodity Channel Index is most effective when used in conjunction with other analytical tools and indicators. Its interpretations and signal generation may vary depending on the time frame and market conditions. Traders and investors often use CCI in combination with trend-following indicators and other momentum oscillators to make more informed decisions and reduce the impact of false signals.

Overall, the Commodity Channel Index provides valuable insights into an asset's price movements, helping traders gauge potential market trends, identify entry and exit points, and manage risk more effectively. However, it's essential to remember that no single indicator guarantees profitable trading outcomes, and proper risk management and thorough analysis are essential for successful trading strategies.